We are now live at UOB.CO.TH/TMRW. Stay up-to-date and experience new features and promotions here.

Get reward when you apply TMRW saving account and credit card!

Up to THB3,400

(Easily authenticate via NDID anywhere, anytime)

GET UP TO THB3,400 WHEN YOU APPLY AND SPEND

THB400 Cashback

into TMRW Everyday Account

when you oepn TMRW saving account + and top up THB5,000 into TMRW Everyday account, get 10% cashback (max cashback THB400) when you spend with TMRW debit card within 45 days from the date of account opening (Require debit card minimum spending of THB1,000 accumulated)

THB3,000 Cashback

into TMRW Everyday Account

when you apply and spend with TMRW credit card on online transactions, get 20% cashback (max cashback THB3,000) (Require credit card minimum spending of THB10,000 accumulated)

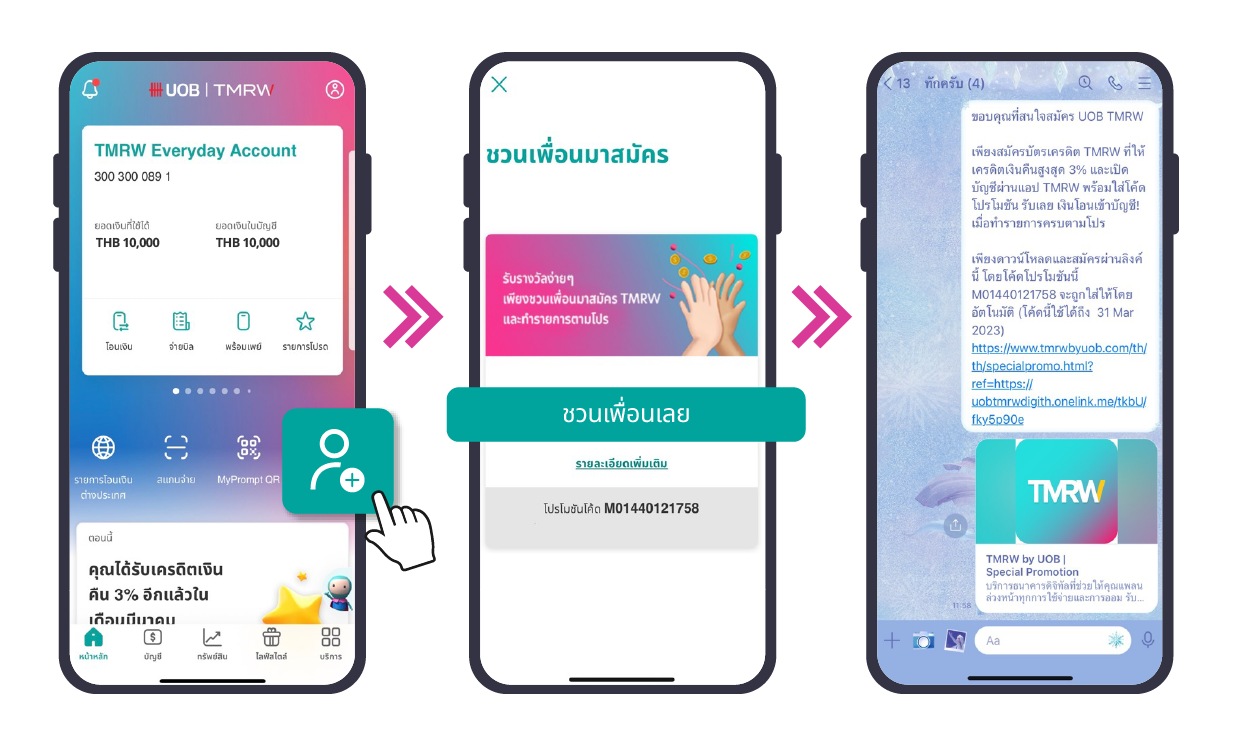

How to share Link to friends

Open UOB TMRW app and click on the Friend Invitation menu to start referring friend. You can send invitation link to friends via many channels.

How to Apply TMRW

Download UOB TMRW App via icon below.

Choose product then click “Apply Now”.

When you open TMRW saving account + top up THB5,000 into your TMRW Everyday account, get 10% cashback (Max THB400) when you spend via TMRW debit card within 45 days from the date of account opening. (Require minimum debit card spending THB1,000 accumulated).

(You will receive cashback upto THB400 into TMRW Everyday account within 90 days from the date of account opening.)

Get 20% cashback (max THB3,000) when you spend with TMRW credit card on online transaction within 45 days from credit card approval date. The Bank will credit cashback into your TMRW Everyday account within 45 days from credit card approval date

(You will receive cashback upto THB3,000 into TMRW Everyday account within 90 days from account opening date).

Terms & Conditions:

• Applications for both TMRW Account AND TMRW Credit Card during the period of 1 May - 21 May 2023.

• We have the discretion to make decisions on all matters relating to this Promotion, including but not limited to eligibility, approving or declining any application, and investigating or declining applications made fraudulently or for illegitimate purposes such as gaming. Where we determine your participation in this Promotion to be illegitimate or inappropriate, we may take such further action as we deem fit including but not limited to closing or terminating one or all of your Accounts, Cards, and/or Services without prior notice to you.

• Value of reward is equivalent to the increase of 8% interest p.a. calculated from value of reward THB400 for THB5,000 deposit amount for 1 year.

• The deposits are under the protection of the laws regarding the Deposit Protection Agency as per the amount and conditions stipulated therein.

*1.3% p.a. interest for the first THB 1 million and 0.25% p.a. interest thereafter.

You will get THB400 into TMRW Everyday when:

(i) Apply TMRW Account, AND

(ii) Deposit at least THB5,000 into his/her TMRW Everyday Account

(iii) Get 10% cashback from TMRW debit card spending and must have cumulative spending of THB1,000 (any types of categories) within 45 days from the date of account opening.

Get 20% cashback from online transactions up to THB3,000 into TMRW Everyday when:

(i) Apply TMRW Credit Card (Bundle application), AND

(ii) Have accumulated spending via TMRW credit card at least THB10,000 within 45 days from credit card approval date, AND

(iii) Get 20% cashback into TMRW Everyday Account when spend credit card on online transaction

(iv) Must be new customers who never use TMRW or/and UOB Credit Cards, or has cancelled the products for more than 6 months.

• For existing customers who currently use TMRW or/and UOB Credit Cards get 20% cashback from online transactions up to THB1,500 into TMRW Everyday when:

(i) Apply TMRW Credit Card (Bundle application), AND

(ii) Have accumulated spending via TMRW credit card at least THB10,000 within 45 days from credit card approval date, AND

(iii) Get 20% cashback into TMRW Everyday Account when spend credit card on online transaction

(iv) Existing customers who currently use TMRW or/and UOB Credit Cards